ADVOCACY IN APPAREL

ADVOCACY IN APPAREL

Style for the second amendment

Already a Member? Log In

$19.99/month

Learn More

Join our Alliance Membership for exclusive offers and to join our thriving community of like-minded Patriots dedicated to Making America Great Again.

Don't miss out!

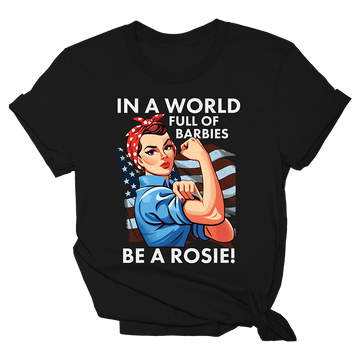

Empower your patriotic spirit with our stylish and versatile women's Patriotic T-shirts, designed to celebrate the nation's pride and honor.

Patriot at heart!

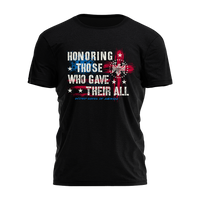

Salute the brave and show your support with our patriotic and stylish military and veteran's t-shirt collection.